Since the beginning of the year, companies have spun off over $1.6 trillion worth of subsidiaries globally, according to Dealogic. During the past 3 weeks alone, a number of large companies have announced plans to split up, signaling a shift from what has been a trend to chase synergies to one that places greater importance on focus. The explosion of these types of announcements has prompted me to ask myself a simple question: why? As I dag deeper into the subject I found there are a number of possible explanations. And a number of potential beneficiaries.

But, before we start, let’s recap what happened in the past month:

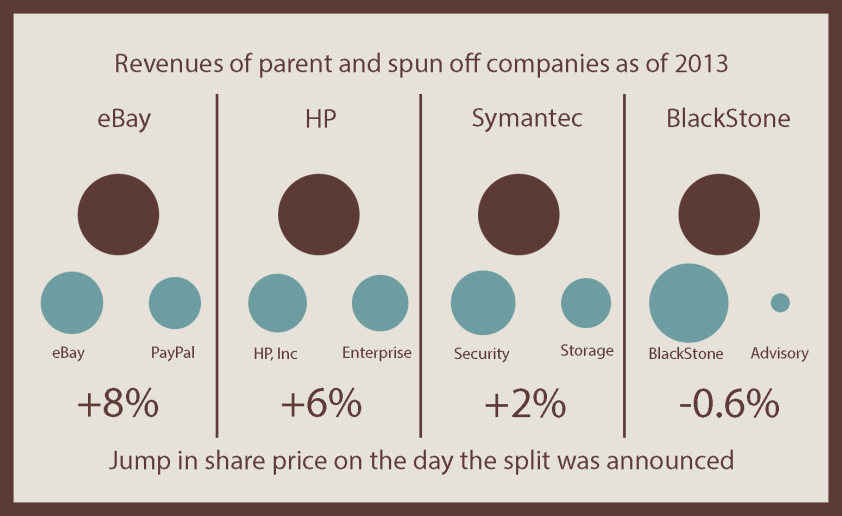

- eBay, the online retailer with a $65B market cap, has announced on the 30th of November that it will spin off its PayPal division. PayPal, founded by the likes of Peter Thiel and Elon Musk, was acquired by eBay back in 2002 for $1.5B, and has grown so far as to be worth half of eBay’s current capitalization (that’s $32B for those of you who hate math).

- HP, one of the cornerstones of the US tech industry, is ready to peacefully separate its personal computer and printer business from the software and enterprise side of the business. The consumer business will be called HP Ink, sorry, I meant Inc, while the sexier corporate side will be called, aptly enough, Hewlett-Packard Enterprise. Both companies will be about the same size, as the consumer business brings in revenues of 55B, while the enterprise side weighs in at 59.

- Symantec, better known for its anti virus software Norton, will be divided in two by the end of next year. One company will focus on cybersecurity, the other on storage and data management. Symantec currently trades a discount compared to other similar software companies, such as FireEye, with EV/EBITDA at 6.1.

- BlackStone has announced it will be acquiring PJT partners, a boutique investment bank (20th on the league tables), combining it with its advisory business, and spin off the resulting division. The advisory business, which is growing at 14% compared with the rest of the company’s 65%, contributed 6.7% of revenues in FY 2013.

Why

Why do companies suddenly decide to part ways and start a new life? Let’s explore some options.

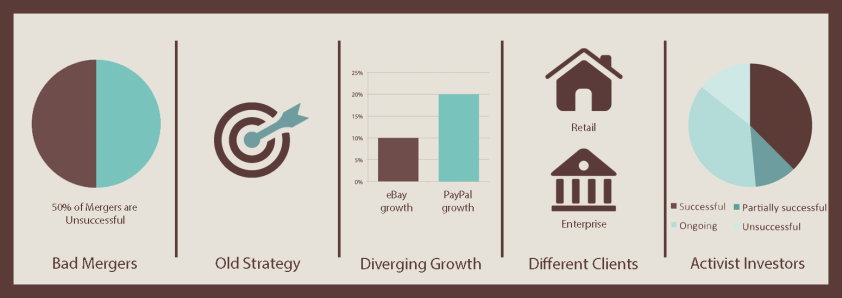

Matches made in hell. Aka bad mergers

CEOs famously want to expand their companies, and sometimes do not stop to think if a deal really does make sense going forward, or they do not properly integrate the merged companies, with the result that the much-vaunted synergies end up never materializing. Symantec is a prime example. The company bought the storage firm Veritas in 2005 for a whopping $13.5B, betting that customers would want a one-stop-shop for storage and security. However, they never did, and Symantec was not able to properly integrate the two divisions, wasting Veritas’s market leadership position in as enterprise backup solution vendor.

The strategy does not work anymore

Whether the company was created through a merger or whether internal diversification caused the company to lose focus, it may be that the strategy currently pursued is not suitable anymore. For example, eBay bought PayPal to secure a strong payment option for its customers. PayPal has since grown its revenues from 1 to $6.6B, and operating profit increased 5.6x times. eBay has become an obstacle to PayPal’s growth, with companies such as Amazon refusing to use the service because it is owned by their rival.

Another example is HP, which bought Compaq, the PC manufacturer, back in 2001, to decrease costs while sourcing hardware components. With components becoming commoditised, savings obtained from combining orders for server and PC parts quickly faded.

You are growing too fast

The value of a firm is usually discounted when a faster growing division is “trapped” into a conglomerate. Businesses growing at different rates moreover need to be managed in very different ways: fast growing PayPal for example requires more investments than stable eBay, who needs to focus on margin expansion and profits.

Who are we selling to?

Sometimes, the two divisions are catering to completely different clients, which makes it harder to manage the company as a coherent whole.

In BlackStone’s case, the advisory division would have increasingly had to face conflict of interests between its clients and BlackStone’s own asset management businesses. The conflicts arise then the firm tries to win a mandate to sell an asset which its private equity business may have an interest in, for example in corporate restructuring the advisory side of Blackstone would be in conflict with the company’s division that buys distressed debt.

In HP case, the enterprise side will be catering to business clients, while the PC and printer side will have to satisfy retail customers, making for a completely different strategy and organization.

Activist Investors

An activist investor buys a lot of shares in a public company he believes to be mismanaged, tries to obtain a seat on the board and bugs management to change the way the company operates or redistributes earnings to shareholders.

Activist hedge funds have returned 22% in 2013, according to Activist Insight, and have more than $110B in dry powder, according to HFR. With more than 230 activist- launched initiatives in 2013 alone, names such as Carl Icahn, Starboard Value, Elliott Management, and ValueAct Capital are fast becoming the reasons behind many of today’s corporate activities.

Who is to benefit?

Workers

Having a smaller, more nimble company allows employees to focus more clearly on their job, and hopefully have a boss who is interested in the part of the business she is leading.

Investors

A growing business is valued differently from a stable one. If a company includes both, the market will usually penalize the stock. In addition, firms that are seen as prone to over-diversification will suffer from a “diversification discount”. Numerous academic studies find that stocks tend to “pop” the day a demerger is announced, gaining on average 3.3% better than the market.

When the actual split happens, shares end up in the hands of investors who might not want them or index funds, which must sell them. In addition, spin offs are usually not covered by analysts. As a result, spun off companies can usually be bought at a discount. The Bloomberg US Spin off Index is up 14.4 YTD, versus SP500 performance of 5.7%

Private equity firms

Smaller firm divisions, especially if they have stable earnings and generate cash, may become PE targets, especially if they are trading at a discount. Of course there is a reason why a stock is cheap, but a PE investment could potentially streamline operations and increase efficiency. Symantec’s security software division could be one such opportunity.

Investment bankers

Any corporate activity brings fees. And, according to Dealogic, banks have collected $9.4B from de-mergers this year alone. Not too shabby, if you ask me.